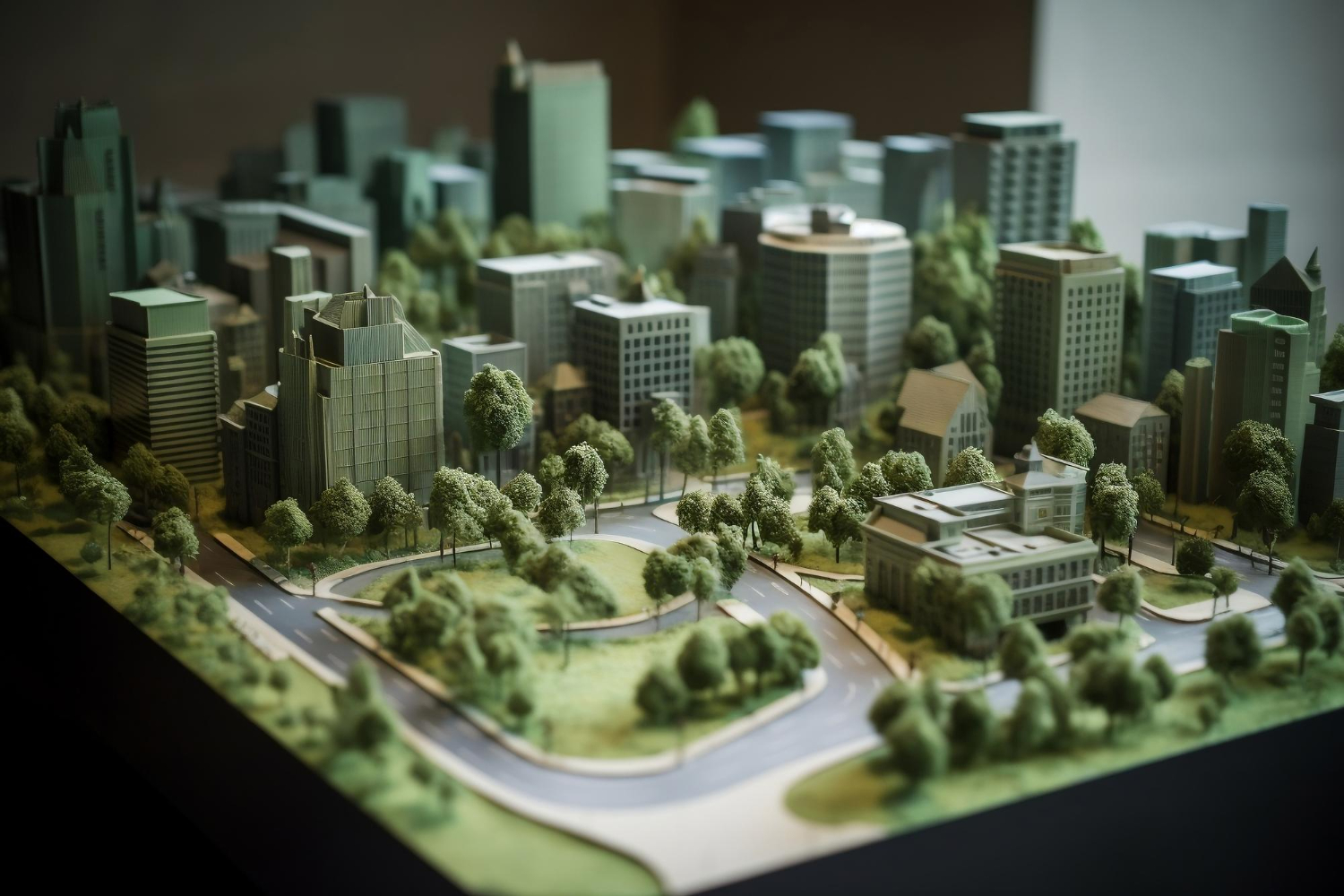

Project Finance in Urban Area

This means that the project assets and revenues generated are used as collateral for securing loans and investments.

In the context of urban areas in India, where there is a growing need for modernization, expansion, and improvement of infrastructure, project finance plays a crucial role in enabling the execution of these projects. The involvement of various stakeholders including government bodies, private investors, financial institutions, and project developers is common in structuring project finance deals in urban areas.

Following are the procedure steps:

1. Project Identification: 2. Feasibility Assessment: 3. Project Structuring: 4. Financing Arrangement:

This may include environmental clearances, land acquisition approvals, zoning permissions, and construction permits.

6. Implementation: 7. Monitoring and Control: 8. Operations and Maintenance: 9. Revenue Generation: 10. Project Evaluation:

Here are a few reasons for you to apply for a Project Finance in Urban Area at Livanity:

Fast assistance: At Livanity, you can contact us at any official working hours of the day.

Customer needs in forefront:

Your needs are our priority. We promise to deliver you with services that are best on our capabilities. By handpicking loan offers based on customer profile, we try to give you the most personalized experience.

Compare Offers Online:

With more than 100 lenders as partners, you can compare the different offers of financial institutions to make the right decision. In fact, we help you find the best lender as per your eligibility requirements. There is a personalized relationship lender for every customer who helps him/her select the bank of his/her choice.

Real-time customer support:

Our customer support team is fast and efficient to clear all your doubts regarding loan eligibility, procedures, offers, documentation and repayment options. We even contact with the respective lender on behalf of you.